Magnesium Production: China Crisis and Growing Opportunity For ROW

Magnesium is one of the most strategic materials in modern engineering and manufacturing of aluminum alloys. The significance of the metal lies in its ability to offer weight reduction in critical components without compromising on strength. The key applications of magnesium are in the fields of automotive, aerospace, medical and electronic, the automotive taking about 62% of its share. The lightweight impact of Al and Mg alloys in transportation is well documented by the U.S. Department of Energy’s Vehicle Technology Office (USDOE-VTO). Global demand for magnesium has significantly increased over the past decade (CAGR 2001-2021 at 5.1%), owing to the unprecedented growth in sectors such as construction, automobiles, iron, and steel, etc.

It is one of the most talked-about metals in 2021 because of the unprecedented price rise it witnessed over the second half of the year and the supply concern that is worrying the consumers of the metal. The global primary magnesium supply in 2021 is estimated to stand at 1.16 million ton, as per the data from the International Magnesium Association. China accounted for 82% of its output, while the US and Russia accounted for the major part of the ROW production of 212Kt. This showed the dependence of the world on China for sourcing one of the strategic materials.

After the Covid-19 pandemic, global primary mg consumption dropped 2% YoY for the first time in 2020. However, the global primary Mg supply was up 1.7% to 1.08 million ton. 2021 saw a rebounding in the economy across the globe with mg demand estimated to grow by 8% YoY. Production is estimated to grow by 6.9% y-o-y. Simultaneously, magnesium prices skyrocketed in the year crossing $11,000/t in September 2021(based on spot prices for magnesium ingot 99.9% min, traded in China), up more than 420% YoY on tight supply and strong demand with the recovery of economic activities after the pandemic.

Several causes were blamed for the increasing prices price of magnesium. China’s new carbon policies and frequent environmental auditioning led to the closure of many coal-based facilities in the country. About 70kt mg capacity in China was forced to close after the implementation of the new carbon policy. Rising prices for ferrosilicon (an input material) were also cited along with higher coal prices. Supply was made tight by higher demand by aluminum smelters and diecasters. The situation was also partially impacted by restricted shipping and high freight rates, especially during the blockage of the Suez Canal in March.

Shaanxi is the leading Mg-producing province in China that produced 558kt of mg in 2020, about 60% of the country’s total production. The province was forecast to increase to 646kt in 2021. Recently, operations were suspended in magnesium plants in some areas of Shaanxi Province, because of a coal supply crunch and power rationing for industrial production. This led to a tight market and price hike driving magnesium prices to an all-time high of Yuan 71,200/mt ($11,147/t) in September (China Nonferrous Metals Industry Association, or CNIA). Beijing had to restore power and allow coal mining to balance the price rise. As per the data from China's National Bureau of Statistics, magnesium output from Yulin in China's Shaanxi province rose only 3% IN Jan-Sept YoY to 416,800 mt.

Notwithstanding the latest developments, rebounding of demand after the pandemic to more than pre-pandemic level, supply crunches across the commodities sector, China’s new carbon policies, and higher magnesium prices have worked in favour of the ROW producers of magnesium in an unexpected way.

After Chinese authorities squeezed magnesium production, auto manufacturers across the world are regretting over-dependence on Beijing for the metal supply. Customers are now practically aware of China risk and looking at buying magnesium from other countries. This has opened up opportunities for ROW mg producers to boost their capacities.

Notably, ROW production has witnessed solid growth over the past few years. Since, 2016-2021, the five-year CAGR for China supply is 4.9%, while for ROW supply registered a CAGR of 9.1%. Among the ROW, the US accounts for 6% of magnesium production, while Russia has a share of 5%. Interestingly, there has been a strong potential for increasing the production of secondary magnesium in the US. Magnesium can be successfully retrieved from the factory scraps of magnesium ingot and castings plants and aluminum alloy scrap at secondary aluminum smelters. In 2020, according to US Geological Survey, about 25,000 tons of secondary magnesium was recovered from old scrap and 65,000 tons was recovered from new scrap in the US. About 55% of the secondary magnesium was recovered from aluminum-based alloys.

The USDOE-VTO is targeting 50% weight reduction in passenger car and light truck bodies and chassis using light metals such as Al-Mg alloys. The demand for light metals, Al, Mg, and titanium (Ti) is rapidly growing in the U.S. civilian and military transportation industries. Strategically, U.S. manufacturing must expedite its domestic production of the light metal to meet expanding demand in these sectors which are driven by light weighting and CAFÉ standards.

The annual domestic Mg market of $200 million is growing at 8%. The current demand for Mg is about 140 kt/y. One US-based electrolytic primary (~50kt/y) and two secondary (~50kt/y) producers provide ~100 kt/y. The balance (~40kt/y) is imported mainly from China and Russia. Currently, the US has only one primary (in Utah) and two secondary (in Indiana and Tennessee) Mg processing plants.

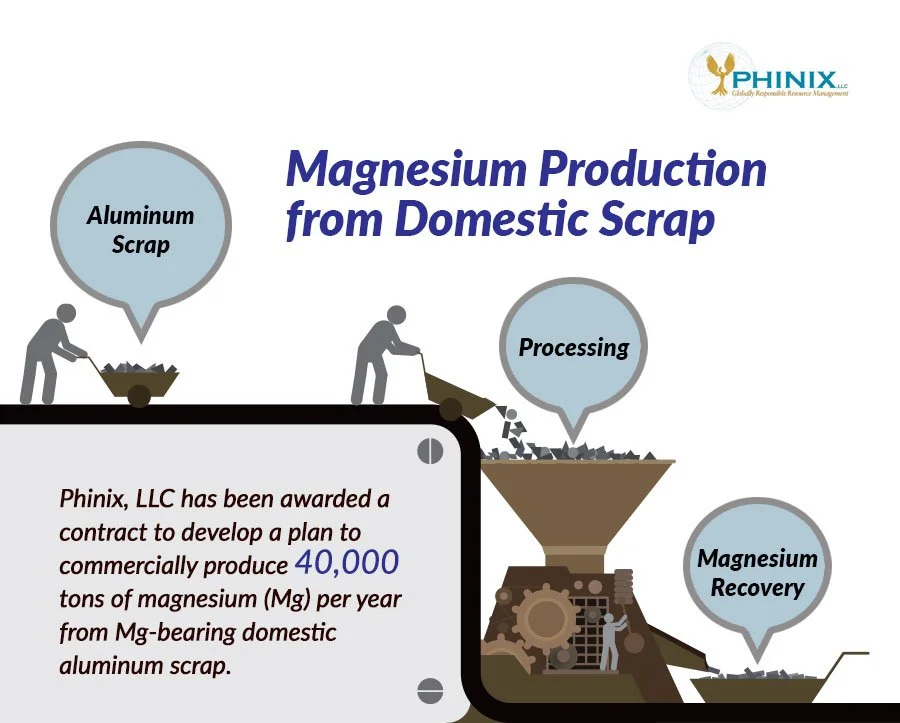

We, at Phinix, LLC, have been commissioned to develop a plan to commercially produce 40,000 tons per year of magnesium (Mg) from abundantly available Mg-bearing domestic aluminum scrap. This will reduce magnesium import from China thereby enhancing United States national security, which has been threatened during the current supply chain crunch. At present, there are no industrial processes that recover Mg from Al-Mg scrap. Hence, low-cost recovery of Mg, a strategic metal for the U.S. industrial and military economies, produced from abundant domestic magnesium bearing aluminum scrap, is of paramount national security interest. It is high time, like all metals we try to create a level playing field for magnesium by boosting domestic secondary production.

We will be discussing the commercialization plan for Phinix’s RE-12TH process. More information about RE-12TH process is available on www.phinix.net